When you travel around the world, especially in other developing countries/cities, you realize that some are way more affordable and expensive than some of the cities in the US. Just like in the US, if a city/state has a lot of demand, population, and influx of people, real estate will cost more money. The supply and demand equation in real estate is simple to figure out.

If you look at the graph below you can see just how expensive it is to live in some cities around the world. Supply/demand and the concentration of wealth in a certain area can drive the prices of real estate up. Look at cities like NY, LA, and Miami which are on this list of top cities in the world. When the 1% of the 1% want to own real estate in these cities they can drive prices up so fast it can price people out forever. Miami probably was the biggest net gain winner of wealth and real estate gains from the pandemic.

The world population is always growing, people are moving all over the world, and buying real estate around the world has become much easier. The amount of cash deals in these cities at the luxury level can be 50 to 100% of purchases, especially in a high-rate environment. More and more people are becoming millionaires and billionaires, so they have the cash to spend, and real estate is always a great asset to have in their portfolio.

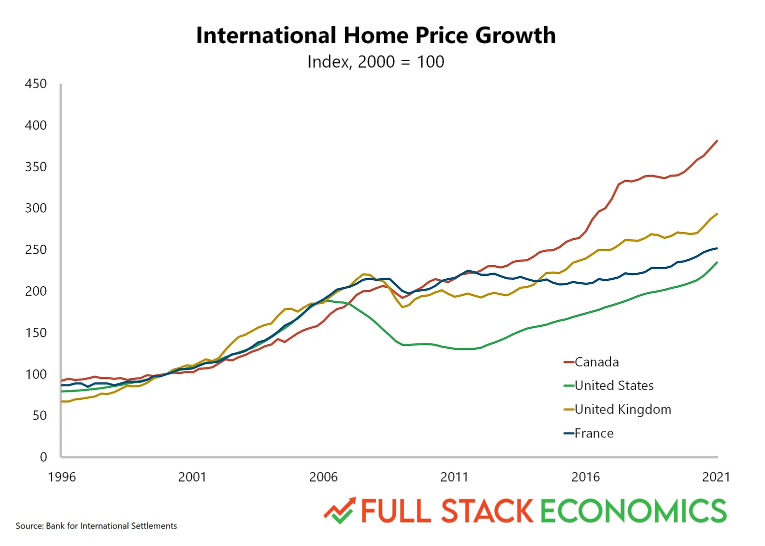

As we tend to focus on where we live or even the US market, we forget to look at metrics from other countries on how their real estate market has BOOMed more or has NOT had a real estate crash. In older cities in the world, you can see over time with population growth, less supply, and demand real estate and rent can go up over time. Lots of these cities have high-paying jobs or a much bigger footprint of millionaires and billionaires who want to live in these cities. These wealthy people move there, start businesses, move business and create jobs/growth in the community.

There are cities in the US outside of NY, LA, and Miami that are slowly showing signs of growth and one day 1% of the 1% might decide to buy a second, or third home or move their business there and create lots of jobs. Or the city could just be a spot where the wealthy want to go and play, which can drive up real estate prices too. Some of these cities in the US are attracting lots of new people as well because they might be the hip new spot to live in that has lots to offer from jobs, weather, things to do, lifestyle, and the list goes on.

Location, location, location in real estate always seems to win in the end. If you are looking to buy or invest in real estate that will see appreciation and growth, find the cities that are attracting the masses and 1% over time. I would imagine it would be hard for you to lose overtime and create wealth with real estate.