There is bipartisan support in the U.S. House of Representatives for the “More Homes on the Market Act”. The bill would increase the sales gain tax exclusion to $500K for single files and $1 Million for joint filers. Currently, it sits at $250K and $500K which was set back in 1997, that seems like a lifetime ago with how much home values have increased over the last 20 + years in the US.

In states like California, where homeowners face some of the highest housing cost in the nation, homeowners have lots of equity in their properties and inventory are at all-time lows, law Makers think this bill will help loosen up some inventory for a state like California.

Many potential sellers have been on the fence in a state like California where they are sitting on BIG equity, they have a choice to sell NOW and pay the taxes or sell later, sit, and wait. Even with $1 million in tax-free money, that is not much for coastal properties in California. There are people sitting on $2, $3, $5 + million in equity, if they sell that is a HUGE hit to them, and their kids might not be enough to push sell. $1MM is better than $500K and I would imagine that would loosen up inventory all over the US, especially in higher-priced areas.

In Washington state, Gov. Jay Inslee (D) recently signed 10 different bills taking aim at supply and affordability issues, including a bill that lifts single-family zoning restrictions to allow for more affordable housing units, as well as more accessible accessory dwelling unit (ADU) permitting and construction within the state.

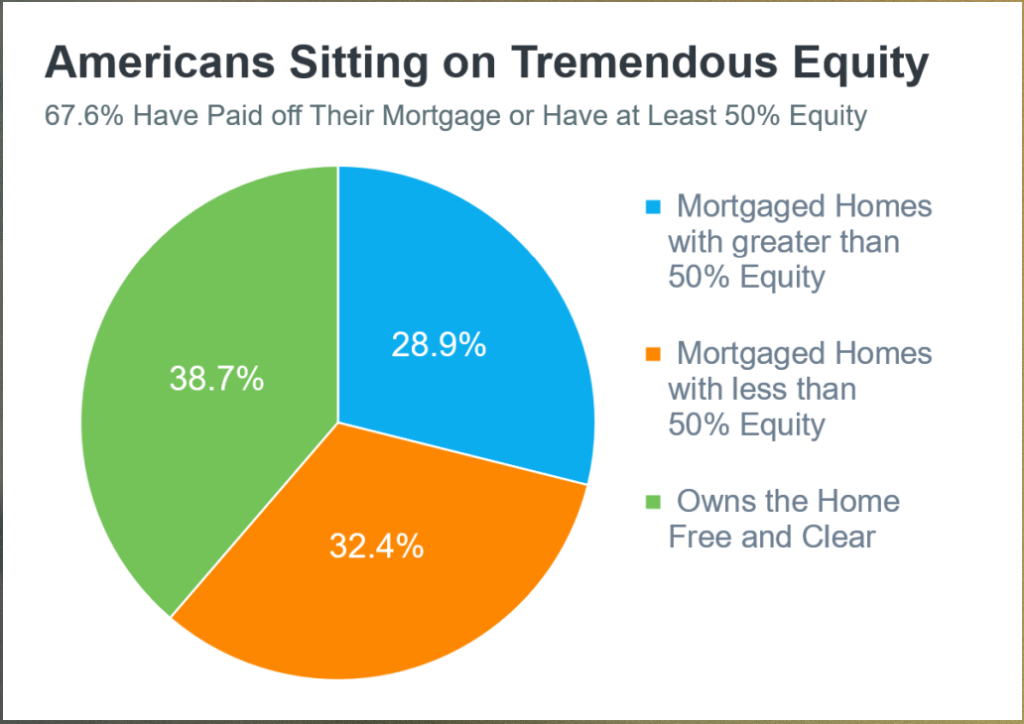

See the chart below, Americans are sitting on tons of equity, 38% of houses are free and clear in the US.