The R-word has been on everyone’s minds for the last 18 months. This has been the most anticipated recession since I have been alive, and everyone has been predicting a recession in the next six months for the last 18 months. The jury is still out if we will have some recession, and many economists believe we are in one now, many believe one is coming, and many believe there will not be a recession.

What is technically a recession? “A period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters.” I think the meaning for everyone might be different. Recession usually means; consumers slowing down, loss of jobs, lenders pulling back, businesses losing money, people hoarding their money, the stock market crashing, the real estate market crashing and the list can go on and on.

So, let’s say we have a recession starting in Q4 of 2023, millions of people start losing their jobs, consumers pull back, inflation comes down and we have that type of scenario. In one way it would be great if inflation came down, the cost of goods comes down like food, gas, travel, essential goods, etc. Another way stock market drops 20% +, lending tightens, consumers pull back, business start to feel the pain and people go into survival mode.

So, let’s say we have a recession starting in Q4 of 2023, millions of people start losing their jobs, consumers pull back, inflation comes down and we have that type of scenario. In one way it would be great if inflation came down, the cost of goods comes down like food, gas, travel, essential goods, etc. Another way stock market drops 20% +, lending tightens, consumers pull back, business start to feel the pain and people go into survival mode.

Let’s go through some of the reasons residential real estate could decline during a recession:

- More inventory due to people must cash out due to loss of job or business slows down.

- People that purchased real estate as an investment that got bad debt, or the deal is bleeding, STR not working out and they need to get out. More inventory

- People must fire sell or panic sell; they start letting properties go fast and for under market value and this hurts values.

- People cannot afford the house anymore and they must sell to get out.

- Buyer demand falls off a cliff.

- Builders must start fires selling properties.

- Overbuilding or supply

- Increase in rates.

- Changes in local government policy, tax laws, zoning laws, etc.

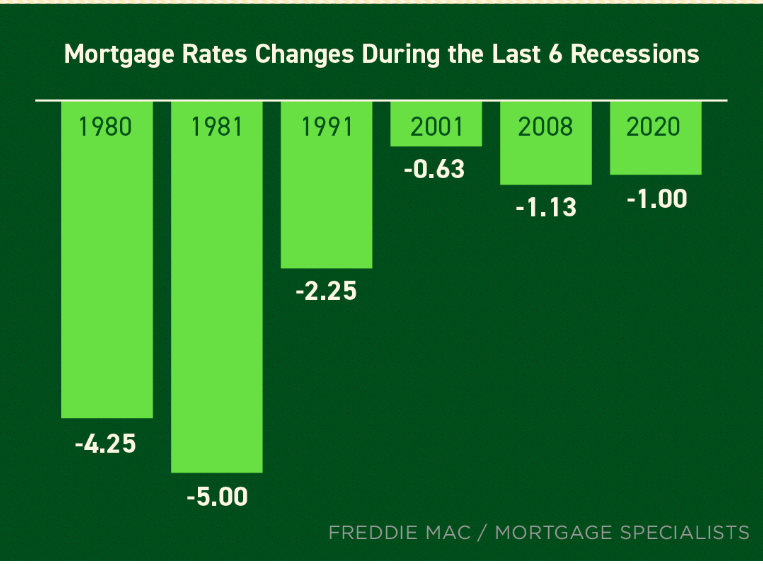

If you look at the charts below you can see what the data shows historically with housing values and mortgage rates during a recession. What is interesting about today’s residential real estate market is that interest rates are high, and inventory is at all-time lows. If there was a lot of inventory with these high rates, we would have seen the market values drop and the market significantly slows down. It would be a great buyers’ market.

So, if we have a recession or slowdown in today’s real estate market, two obvious scenarios can happen. Scenario # 1, Rates drop, buyer demand surges and inventory remains low, that will NOT cause housing prices to decline. Scenario # 2, the recession is much worse than we thought, millions of people lose their jobs, rates drop, buyer demand is not very strong, lots of inventory hits the market due to panic selling and flight to cash, and the markets start to decline due to panic. Yes, there could be other scenarios and many more factors with the economy.

My 2 cents are that housing will do OK because we have such low inventory and everyone is locked into low rates. There really is NOT much motivation to sell or move and homeowners are in a much better financial position than prior recessions. When rates drop, there is going to be a MASSIVE surge of buyers entering the market, that is one thing I know that is certain.